Top 3 Home Improvements That Help You Sell Faster in the Summer

Read More

Mid-Year Real Estate Check-in - Are We Headed for a Shift?

Read More

October Newsletter

# How Can You Smartly Step Into Homeownership in Danvers This Fall? The North Shore real estate market is experiencing some interesting shifts this fall. If you are thinking of buying or selling a home, especially in Danvers, now might be the time to pay attention. With important changes in inventor

Read More

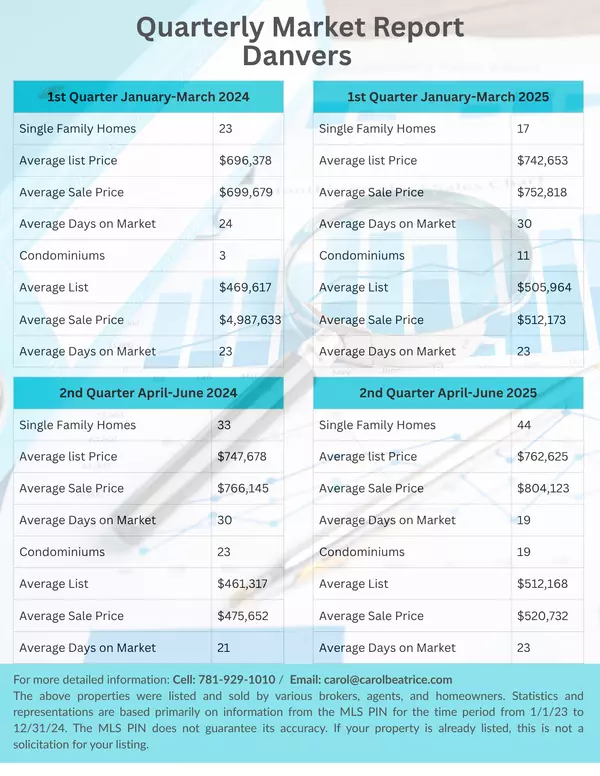

Danvers 1st & 2nd Quarterly Market Report

Read More